With a new US administration taking office, the cryptocurrency industry will likely see significant policy changes that could reshape its future. With promises of clearer regulations and a more supportive stance, these developments may catalyze growth and innovation within the sector while fostering greater institutional confidence.

In this article, we aim to distinguish what is confirmed from what remains speculative. By doing so, we want to provide a balanced perspective on the potential impact of these changes, offering clarity in a fast-evolving landscape.

We will focus on three key aspects:

- The US as the world’s crypto capital

- Market sentiment

- Regulations

Let’s jump right in.

Market Sentiment After Trump’s Cryptocurrency-Focused Campaign

Favorable policies and market sentiment are expected to draw more institutional players into the crypto space, bolstering its growth and stability.

Previous Bullish Market Indicators

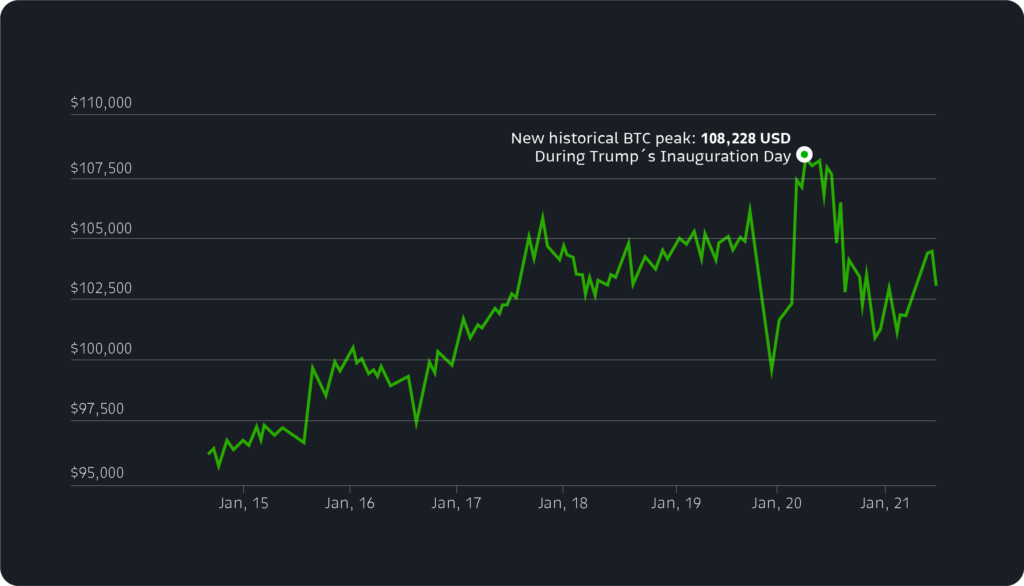

The cryptocurrency market has historically responded positively to news of regulatory clarity and institutional interest. A notable example is bitcoin’s surge past 100.000 USD nearly a month after Trump’s victory, signaling that the crypto market had already responded well to the policies expected under the new administration. This milestone underscored the strong correlation between political developments, clear regulations, and bullish sentiment.

And as if that wasn’t enough, bitcoin recently achieved a new all time high of $108,000 after Trump announced the formation of a crypto council, a campaign promise aimed at guiding his administration’s blockchain strategy. This milestone underscores the strong correlation between political developments, clear regulations, and bullish sentiment.

This historical precedent suggests that even incremental policy improvements could drive similar market optimism. Institutions, traditionally hesitant due to regulatory uncertainty, may view these developments as a green light for deeper market involvement.

Trump’s Crypto: A Key Element of Trump’s Campaign

The Trump campaign’s use of cryptocurrency as a funding mechanism showed a clear sign of support for the crypto scene. The World Liberty Financial initiative, spearheaded by the Trump family, played a role in supporting campaign efforts. The project’s token, WLFI, was strategically structured to align with regulatory compliance while capturing public interest.

At its core, World Liberty Financial presented itself as a crypto banking platform designed to enable borrowing, lending, and investment in digital assets. To ensure accessibility and transparency, 63% of the WLFI tokens were made available for public purchase, 17% were allocated for user rewards, and 20% were reserved for the founding team, which included the Trump family. This allocation structure followed revisions aimed at addressing concerns about disproportionate founder equity, as initial drafts suggested a 70% founder share.

The WLFI token was offered as a Reg D token, adhering to the Securities and Exchange Commission’s Regulation D. This framework allowed the campaign to raise capital without registering securities, provided specific conditions were met. By avoiding pre-sales or early buy-ins, the project sought to emphasize fairness and compliance, building public trust.

Global Competitiveness: Trump on Crypto as a National Policy

The new administration’s vision to position the US as a global hub for crypto innovation, hinges on strategic incentives and competitive policies.

Incentives for Businesses

Trump has pledged to appoint a SEC chairman with a pro-free market stance, signaling a shift from previous regulatory practices. This leadership change aligns with broader plans to streamline business operations and foster investment in transformative technologies.

One of the administration’s cornerstone proposals is a bill aimed at expediting permitting and approval processes for companies investing $1 billion or more. This ambitious measure contrasts sharply with earlier legislative frameworks that often hindered large-scale investments with bureaucratic delays. By accelerating these processes, the administration hopes to attract major corporations to establish or expand their operations within the U.S.

Such policies could revitalize regions like Silicon Valley, encouraging a resurgence of blockchain startups and attracting global firms seeking a stable regulatory and operational environment. However, this proposal faces challenges, particularly with the National Environmental Policy Act (NEPA), an environmental law that requires thorough reviews for large infrastructure and energy projects.

Clear Stablecoin Guidelines

Stablecoins represent a vital segment of the crypto industry, serving as a bridge between traditional finance and blockchain-based systems. The administration’s development of clear regulatory standards for stablecoins could bring much-needed stability to this market. Ensuring that stablecoins meet stringent security and reserve requirements would foster trust and enable broader adoption in payment systems.

A robust framework could also encourage the integration of stablecoins into mainstream financial services, enabling faster and more cost-effective transactions. This integration has the potential to revolutionize cross-border payments, remittances, and other financial operations, positioning the US as a global leader in financial technology.

Is this a certainty under the Trump administration? We won’t be able to tell until the new Congress is inaugurated. However, there’s a bill to establish a framework to regulate and clear the status of stablecoins. If passed, it is unlikely to be vetoed by the reportedly pro-crypto Trump administration.

National Reserve Strategy

There has been speculation about the US adopting a national reserve strategy involving bitcoin, which has captured attention. This is another of the new administration’s campaign promises and, while not yet confirmed, such a move could provide multiple benefits:

- Establishing cryptocurrencies as a legitimate asset class.

- Reducing the volatility associated with speculative trading.

- Preventing “bad actors” from accessing bitcoin.

By holding Bitcoin as part of a strategic reserve, the US could set a precedent for other nations, further solidifying crypto’s role in the global financial system.

If realized, this strategy could also contribute to price stability. A national reserve could act as a buffer during periods of extreme volatility, promoting a more stable market environment. Moreover, it could signal institutional confidence in bitcoin’s potential to maintain value over the long-term, inspiring broader adoption among both public and private entities.

However, there is also a case to be made against a federal bitcoin reserve. Such a reserve carries economic risks. Establishing one would commit the state and taxpayers to backing bitcoin, a financial asset known for its volatility and speculative nature. And, while it could benefit the US, it offers little advantage to the broader crypto market.

Crypto Mining Incentives Within U.S. Territory

Crypto mining was one of Trump’s key overtures to the crypto scene, jokingly saying, “You’ll have so much electricity you won’t know what to do with it.”

Incentivizing domestic crypto mining operations could address a key concern: economic opportunity. Mining incentives could also reduce the reliance on foreign mining operations, enhancing national security and control over blockchain networks. This strategy aligns with broader efforts to position the US as a self-reliant leader in the global crypto ecosystem.

Trump even emphasized his desire for all crypto mining to take place within U.S. territory, declaring during the Bitcoin Conference in Nashville that “If crypto is going to define the future, I want it to be mined, minted, and made in the USA.”

Regulatory Landscape: What Are Trump’s Deregulation Policies?

Regulatory clarity is one of the most anticipated changes under the new administration. Clear, well-defined policies should provide a stable foundation for the crypto industry’s growth and expansion.

Clarity Over Enforcement

The previous approach of “regulation by enforcement” often penalized legitimate players attempting to navigate an ambiguous environment. Businesses faced lawsuits and penalties even when actively working towards compliance. Under the new administration, this stance is expected to shift to a more constructive approach. Providing detailed guidelines rather than imposing punitive measures could foster growth while ensuring compliance.

For instance, the distinction between utility tokens and securities has long been a gray area. A clarified framework could ensure that crypto projects understand their obligations and can operate without the fear of arbitrary enforcement actions.

Leadership Changes

A key component of regulatory shifts will be the leadership in critical agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). During his campaign, Trump pledged to remove the incumbent chairman of the SEC, Gary Gensler, who led a crypto crackdown during the Biden administration. While it is not within the president’s authority to directly remove the chairman of the SEC, Gensler announced that he would step down as the new administration takes office.

The new chairman would be Paul Atkins, CEO of Patomak Partners and a longtime crypto advocate. The incoming SEC chair is poised to reshape the agency’s enforcement strategy, focusing on striking the right balance between protecting the industry from fraudsters and fostering innovation. The crypto industry has long called for targeted enforcement against clear cases of fraud and Ponzi schemes rather than penalizing legitimate players attempting to navigate the complexities of a nascent market.

New Legislative Proposals (SAB 121 Repeal)

The repeal of SAB 121—a rule that imposed onerous reporting requirements on companies holding digital assets—is a much anticipated move. By removing this barrier, firms could adopt digital assets more seamlessly without being burdened by complex liability reporting. This change could encourage financial institutions and corporations to integrate cryptocurrencies into their operations, boosting mainstream adoption.

Revised custody regulations are another of the crypto industry’s most sought-after reforms. Eliminating the requirement for public companies to declare crypto assets as liabilities could enable financial institutions to securely hold digital assets on behalf of clients. This capability is critical for fostering institutional adoption, as many large investors demand robust custody solutions before entering the market.

Last May, bipartisan legislation was passed by Congress to repeal the bulletin that established this obligation, but President Joe Biden vetoed it. This could change this year with the Trump administration. Simplifying these rules may allow traditional banks to compete with crypto-native firms in offering custody services, opening up the market and making crypto appear more secure and user-friendly to those outside the crypto environment.

Secondary Market Oversight

Addressing secondary trading challenges in the crypto market could significantly enhance the industry’s growth trajectory and help retain blockchain projects within the US. The collapse of FTX underscored the need for robust exchange regulation. However, many argue that consumer protection laws, like those found in money transmission regulations, might better address these issues than broker-dealer frameworks. A tailored regulatory approach could ensure that consumers are protected without imposing impractical requirements on the industry.

International examples, such as Japan’s treatment of crypto as a form of money rather than securities, illustrate the benefits of pragmatic oversight. Japanese consumers were largely shielded from the fallout of FTX due to these protective monetary authority rules. This model highlights how clear and balanced regulations can both safeguard users and foster industry growth, providing a compelling framework for US policymakers to consider.

Trump and Crypto: A Cautious But Optimistic Outlook

While the outlook is promising, challenges remain. Striking the right balance between fostering innovation and ensuring consumer protection will be key. Stakeholders must stay prepared to adapt to evolving regulations and market dynamics.

The global competition to attract blockchain businesses continues to intensify, and the US will need to demonstrate its commitment to innovation without sacrificing security. Collaborative policymaking and consistent stakeholder engagement will be critical in maintaining this balance.

As a platform committed to providing secure and transparent crypto trading, Bitso remains neutral in its analysis of political and regulatory developments. Our goal is to empower users with the tools and knowledge to navigate the evolving cryptocurrency landscape.