Crypto vs. ETFs: The balance your portfolio needs

In the pursuit of maximizing your returns, it is essential to have clarity about the tools you use. Often, the conversation centers on two protagonists with opposing philosophies: the growth power of cryptocurrencies and the diversified solidity of ETFs (Exchange-Traded Funds).

For the modern investor, it’s not about choosing an extreme. It’s about understanding how each option can serve as a tool to achieve your goals of freedom and control. The ETF can be the anchor for stability, while cryptocurrency is the pathway to a new economy.

Understanding the difference in fluctuation and control you gain with each element is fundamental to making smart decisions. Here, we show you how these two elements compare and how Bitso allows you to combine them for a powerful strategy.

What are ETFs and what are cryptocurrencies?

What are ETFs?

Imagine an ETF as a basket of elements (stocks, bonds, etc.) that is traded as a single option. By buying an ETF, you invest in dozens or hundreds of companies at once.

- Key advantage: They offer immediate diversification, meaning the movement of a single element falling is diluted. They are a key component for a long-term, lower-volatility strategy.

What are cryptocurrencies?

They are digital elements that operate on a network without intermediaries, such as blockchain technology. They represent an investment in the evolution of the monetary system.

- Key advantage: They provide direct access to the digital economy and high potential for returns. Their value is tied to adoption and technological innovation.

Advantages and disadvantages of each

The choice depends on your goal of focus and resilience.

The strength of ETFs: Stability

The main advantage of an ETF is that, by investing in a basket of elements, the fluctuation of a single company failing is diluted. An ETF offers immediate diversification and tends to be less volatile than an individual element, making it an excellent stable anchor for your portfolio.

The strength of crypto: Growth potential

Cryptocurrencies offer a greater potential for returns due to their high volatility. Furthermore, they give you the freedom to trade 24/7, without the closure of the traditional market. However, this high volatility demands greater tolerance for fluctuation.

Control is in your hands

The philosophy behind each option influences how you interact with it.

- ETFs: Your investment follows a predefined basket. The strategy is passive and focuses on the long-term horizon.

- Cryptocurrencies: Decentralized technology grants you freedom to invest in crypto. Regulated platforms like Bitso give you total control over your operations, 24 hours a day, 7 days a week. Informed management allows you to take advantage of the constant market availability.

Combine the best of both in the Bitso app

The investor seeking freedom should not be limited by rigid systems. Bitso allows you to be a complete strategist, bringing together the best of both worlds:

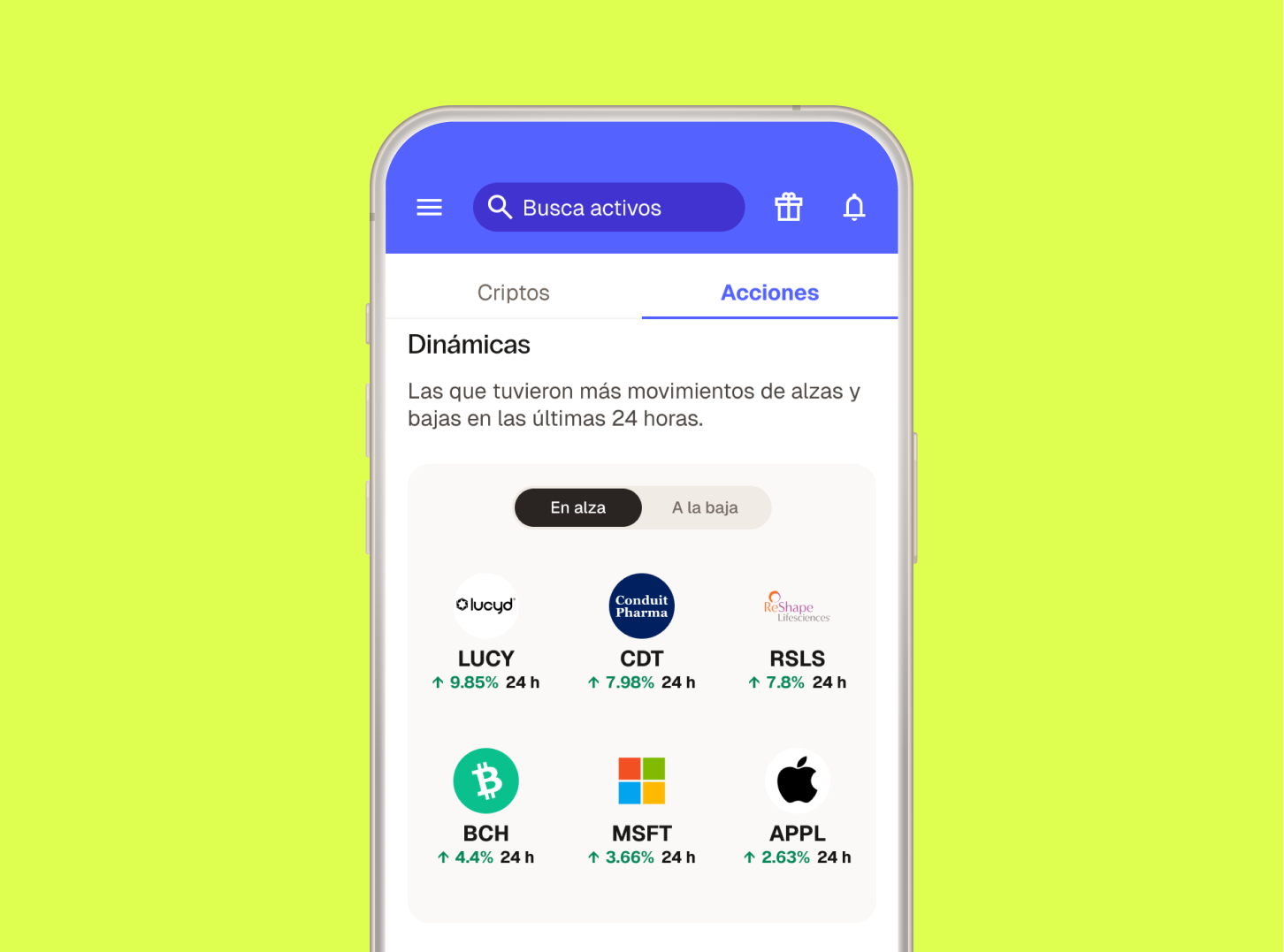

- Everything in one app: Stocks, ETFs, and over 130 cryptocurrencies, all in one place.

- Simple management with pesos: Use your pesos to buy ETFs and to invest in cryptocurrencies.

- Zero commissions: By investing in stocks and ETFs on Bitso, you eliminate unnecessary management costs.

The path to financial solidity consists of leveraging the stability of ETFs with the dynamism of cryptocurrencies to strengthen your financial strategy.

Diversify with strategy: combine control and fluctuation.

If you are in Mexico, invest in ETFs and cryptocurrencies, all in one app, with Bitso.

It’s time to take control.

Open or download the Bitso app and take control of your money today.