Bitcoin ETF Approved in the US

After a long wait, the spot Bitcoin ETF was approved in the US! This development can significantly change the crypto market and may also lead to a major increase in BTC prices.

Continue reading to understand more about the Bitcoin ETF and what this means for you as an investor.

First, what is an ETF?

ETFs are investment funds that are traded in the stock market and can be purchased through various trading applications. The most popular ones track major stock market indices, such as the S&P 500 and other traditional assets and commodities like oil and gold.

The Bitcoin ETF

A Bitcoin ETF provides investors with exposure to bitcoin’s price movements without the need for direct ownership of the cryptocurrency. It works like this: large funds such as BlackRock, Fidelity, and VanEck, invest in Bitcoin. They then allow their clients to trade and invest in these funds without owning the underlying asset.

This makes Bitcoin more accessible to conventional markets, as it can be traded through brokerage accounts wherever these funds operate.

Market impacts

According to experts, the launch of the Bitcoin ETF in the US consolidates cryptocurrencies as a more established and accepted asset class. It shows regulatory confidence in the cryptocurrency, which could spur further investments and developments in this technology.

This move is expected to attract a wider range of institutional investors. The ETF provides a familiar framework, making it easier for these large-scale investors to enter the crypto market. Additionally, it might encourage the development of more crypto-based financial products, further integrating digital currencies into the mainstream financial system.

One significant implication of the Bitcoin ETF approval is the possibility of bitcoin becoming available to every retirement or IRA account in the US. This inclusion could unlock trillions of dollars in investment in bitcoin, significantly increasing the cryptocurrency’s market capitalization and liquidity. The integration into retirement and IRA accounts represents a monumental shift in the perception of bitcoin, moving it from a purely speculative investment to a mainstream financial asset.

In the long term, the sector might enjoy greater liquidity and see BTC’s volatility decrease, due to a broader acceptance of cryptocurrency as an investment.. The increased liquidity and stability can also pave the way for using cryptocurrencies in more conventional financial transactions like loans and savings, thus expanding its utility beyond mere investment. Overall, the approval of a Bitcoin ETF in the US is a significant step towards the maturation and wider acceptance of cryptocurrencies in the global financial landscape.

What can the past teach us?

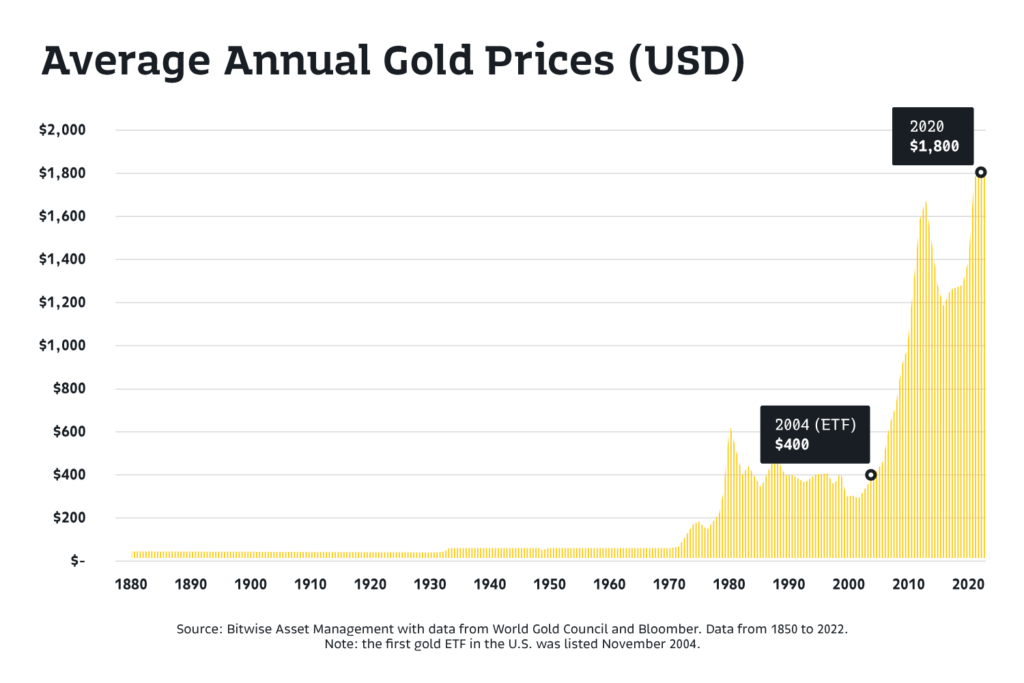

In the past, other ETF approvals have shaken up the market. When the first Gold ETF was approved in 2004, the market saw a significant uptick in liquidity and interest from mainstream investors, ultimately leading to an increase in its price, making gold worth four times more in the following eight years.

Check it out:

A similar trend could follow with the Bitcoin ETF now approved, boosting bitcoin’s price and overall market capitalization.

Investing in Bitcoin

For over ten years, Bitso’s customers have experienced the benefits of buying and holding bitcoin. Investing in BTC directly instead of through an ETF, presents several advantages. It secures absolute ownership, providing investors with autonomy and confidentiality. It empowers you to manage your bitcoin holdings without relying on intermediaries, staying true to the decentralized spirit of cryptocurrency.

Also, direct investment avoids the complex risks associated with ETF management and operations, notably counterparty risks and the uncertainties of fund liquidation. Investing directly allows you to embrace a more straightforward and potentially more rewarding bitcoin investment experience.