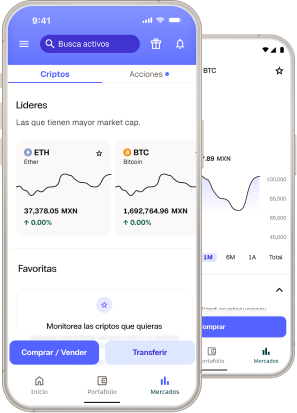

Summer has been so far a whirlwind of events in the crypto world. In early June, a regulatory storm came as major exchanges like Binance and Coinbase faced legal actions from the U.S. Securities and Exchange Commission (SEC). These lawsuits raised concerns about the regulatory compliance of crypto exchanges and sent shockwaves through the market.

One month later, on July 13, 2023, Ripple Labs secured a landmark legal victory as a U.S. judge ruled that the company did not violate federal securities law by selling its XRP token on public exchanges. A huge victory for the crypto industry, as it’s the first time a cryptocurrency company has won a case brought by the SEC.

As a result, the value of XRP surged by 75%. The case has been closely watched in the cryptocurrency industry, as it challenges the SEC’s assertion that most crypto tokens are securities and subject to strict investor protection rules.

While the crypto industry grapples with these challenges, macroeconomic factors like inflation and interest rates continue to influence investor sentiment and shape the direction of traditional assets and cryptocurrencies alike. Investors are assuming the Fed is close to ending the hiking cycle. Inflation has been slowing down in the past months and some indicators show that the US economy may be decelerating. The change in monetary policy has been one of the drivers of the performance of technology stocks and crypto, assets that were terribly beaten down last year.

In fact, the price action we are seeing in the crypto market these past months is quite constructive. When the SEC announced its enforcement actions against Binance and Coinbase, the news caused a sharp decline in the prices of major cryptocurrencies particularly in those that may be deemed as securities. However, the markets quickly bounced back after the initial drop, with some cryptocurrencies even reaching new highs in the days following the announcement. From an investor perspective, this is quite positive. After such negative news, we have not seen a meltdown in prices. News about Blackrock’s Bitcoin spot ETF filing has raised expectations of an institutionally driven rally in the coming months and has also provided support to prices.

If we check the Bitcoin price development in the last months, many technical analysts agree that Bitcoin has completed an inverted head and shoulders structure that is positive for future price developments.

An inverted head and shoulders structure sounds great! But… wth is it?

| Imagine that you have a drawing of the head and shoulders of a person. Normally, the head is in the middle and the shoulders are on each side. Well, a reversed head and shoulders pattern is when the drawing looks different. In an inverted head and shoulders pattern, the lowest point is in the middle, like a head. Then there are two higher points on each side, like the shoulders. It is called “inverted” because it is like the normal pattern but flipped around. When analysts see an inverted head and shoulders pattern, it often means that the price could go up soon. The most interesting thing about this pattern is that during the SEC-induced crisis the key significant level of the $25k line held up very well. |

️ But with every cloud comes a silver lining!

While in the US the industry is under heavy regulatory attack and uncertainty, Asian governments are opening up to digital assets, with Hong Kong reinstating retail crypto trading at select exchanges and is reportedly wooing mainland China crypto firms in a bid to bolster its finance hub status. You go Glenn Coco Asia! ❤️