Unlike traditional markets where investments like stocks and bonds may offer some stability, the crypto market is known for its high volatility. While it can bring significant growth opportunities, this volatility also comes with considerable risks. As a result, investment diversification is crucial to safeguard your portfolio.

In this post, we’ll guide you through the main principles of crypto portfolio diversification. We’ll go over:

- What is diversification?

- The different types of cryptocurrencies available

- How each can contribute to your investment strategy

Whether you’re aiming to build the best crypto portfolio or just learning how to diversify your crypto portfolio, these insights will help you out. Let’s get started.

What is diversification?

Diversification is a fundamental principle in the investment world. It consists of spreading your investments across a variety of assets to reduce the overall risk of your portfolio. Instead of putting all your funds into a single type of asset or a single market, diversification involves creating a balanced mix of investments. And for many investors, this includes creating a crypto portfolio.

A good diversification strategy will give you:

- Protection against volatility

The crypto market is characterized by volatility. However, some crypto assets, such as stablecoins, are less volatile than others. Diversification allows you to control your exposure to market fluctuations without risking your entire investment by balancing volatile assets with stable ones.

- Optimized Returns

Diversification isn’t only about protecting your funds against volatility. It also allows you to take advantage of growth opportunities in different areas of the crypto market. For example, while bitcoin may be stabilizing, an emerging altcoin might be experiencing rapid growth. By having a diversified crypto portfolio, you can achieve returns from multiple sources.

Diversification is not as simple as buying a variety of cryptocurrencies randomly; it involves carefully selecting assets that, when combined, will provide you with a risk/return profile that aligns with your financial goals.

Understanding Different Cryptos: The Key to Risk Diversification

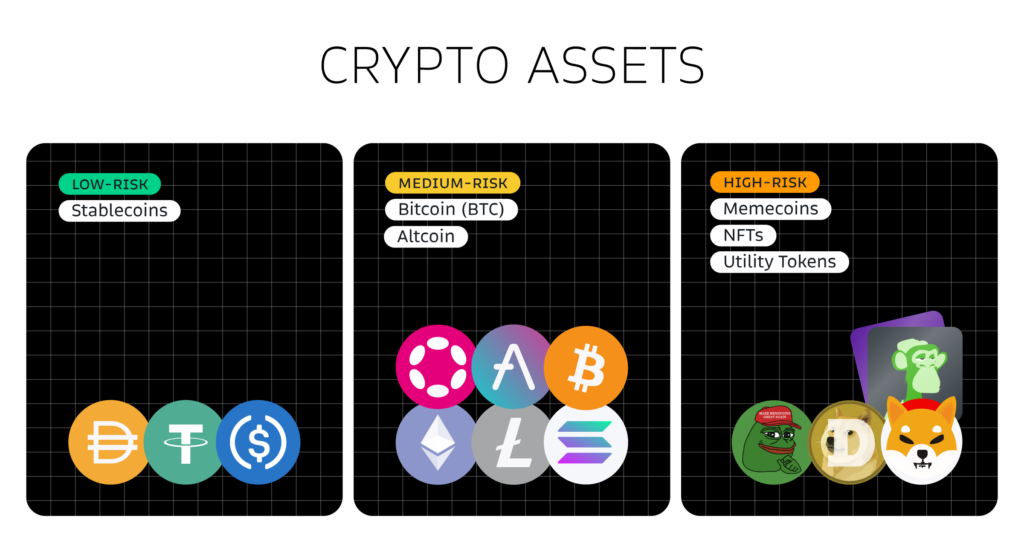

The cryptocurrency market is vast and diverse, with a wide range of assets, each serving different functions within the blockchain ecosystem. To build a well-diversified crypto portfolio, it’s crucial to understand the various types of cryptocurrencies available and how each of them can play a specific role in your investment strategy. Let’s take a look at some of the main ones, classified by their risk level:

Low-Risk Crypto Assets

Although any crypto investment carries some risk —which is why it’s advisable to invest only what you can afford to lose— some are safer than others. Currently, the crypto assets considered to be lower risk are stablecoins, as they tend to have lower or at least more predictable volatility.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. Some examples (and popular) stablecoins are Tether (USDT) and USD Coin (USDC). They are useful tools for investors looking to minimize volatility in their wallets. Stablecoins are commonly used for transactions, saving, or as a temporary store of value during periods of high volatility in the crypto market, and even in traditional markets.

Want to learn more about stablecoins? Check out our exclusive guide.

Medium-Risk Crypto Assets

If you’re looking for something riskier than stablecoins but with greater potential returns, there are plenty of cryptocurrencies to choose from. With good research, you’re sure to find a project that suits you.

Bitcoin (BTC)

Bitcoin isn’t just the first-ever cryptocurrency, but also the most famous. Its decentralized network and limited supply of 21 million units have made it a preferred option for those looking to protect against inflation and monetary policies. This limited supply is akin to other scarce resources like gold, which can help preserve its value during times of high inflation, especially when the value of fiat currencies declines significantly. Although bitcoin is relatively stable compared to other cryptocurrencies, its value can still experience volatility, making it a fundamental —but not exclusive— part of a diversified wallet.

Altcoins

Altcoins is a generic term that refers to all cryptocurrencies that aren’t bitcoin, including stablecoins (low risk) and memecoins (high risk). Many of them, such as the native cryptocurrencies of the Ethereum (ETH), Polkadot (DOT), and Solana (SOL) networks, have been developed to address certain limitations of the bitcoin network or to offer additional features.

These cryptocurrencies are often linked to specific projects aiming to solve technical problems or create new applications within the blockchain space. Investing in altcoins can offer high returns, but it also comes with greater risk, especially with those that are part of emerging projects. If you’re interested in crafting a crypto portfolio with medium-risk assets, your best options are the native coins of more established networks, including Bitcoin.

High-Risk Crypto Assets

Finally, if you’re interested in volatility, high returns, and taking on the significant risks that come with certain types of investments, the crypto market has something for you. Whether you want to do day trading with memecoins or bet on the NFT art market, there are plenty of options for you to explore.

Memecoins

Memecoins, such as Dogecoin (DOGE) and Shiba Inu (SHIB), are cryptocurrencies that initially emerged as a joke or a fun cultural experiment within the crypto community. Despite their humorous origins, some memecoins have gained significant popularity and experienced substantial increases in value, thanks to support from online communities and influential figures.

Although they often lack practical use or solid technical development, memecoins have captured the attention of speculative investors, due to their potential for quick and high returns. However, these cryptocurrencies are also extremely volatile and risky, as their prices tend to depend more on market trends and sentiment than on solid fundamentals.

Diversifying your crypto portfolio with memecoins can be part of a high-risk, high-reward strategy, but it is crucial that investors are aware of the associated risks and are prepared for the possibility of large fluctuations in their value.

NFTs and Utility Tokens

Non-fungible tokens (NFTs) and utility tokens represent other niches within the crypto market. NFTs are unique digital assets used in digital art, gaming, and other media, while utility tokens allow access to specific services within a blockchain project. Although they can be highly speculative, they also offer unique investment opportunities in emerging areas.

How to Diversify Your Crypto Portfolio

Now that you are familiar with the different types of cryptocurrencies and their uses, the next step is to develop a crypto investment strategy that fits your financial goals and risk tolerance.

Here are some key strategies you can use:

Diversification by Risk Level

One straightforward way to diversify your wallet is to allocate your investment among different types of cryptocurrencies according to their risk level. This could include a mix of bitcoin, ether, stablecoins, altcoins, DeFi tokens, NFTs, and memecoins. By diversifying in this manner, you gain access to a wide range of assets with varying levels of risk and potential return.

For example, you could allocate:

- A percentage of your investment to bitcoin as a long-term store of value

- Another percentage to ether for its potential in decentralized applications.

- A small portion in memecoins for speculation.

- The rest can be distributed among stablecoins for stability.

Diversification by Use and Sector

In addition to diversifying by risk level, you could also consider the different sectors within the crypto ecosystem. For example, you could diversify among cryptocurrencies used in decentralized finance (DeFi), tokens for smart contract platforms, coins geared towards daily transactions, and those linked to digital art and gaming.

For example, you could invest in:

- A mix of ether (smart contracts),

- UNI of Uniswap (DeFi)

- AXS of Axie Infinity (NFTs and gaming)

With this crypto investment strategy, you are exposed to multiple sectors that could grow independently.

Reevaluation and Rebalancing

The cryptocurrency market is dynamic, and what constitutes good diversification today may not hold tomorrow. It’s important to periodically review your wallet and rebalance it based on market conditions and your own goals. This could involve selling cryptocurrencies that have significantly increased in value to rebalance your crypto portfolio or adjusting investments based on new developments in the market.

For example, if your investment in ether has grown significantly and now represents a larger portion than desired in your wallet, you might sell a part and redistribute it into stablecoins or a new promising altcoin.

Build Your Crypto Portfolio and Start Investing with Bitso

Are you interested in the world of cryptocurrencies? Bitso is your best ally. With over 50 cryptocurrencies listed, Bitso is an exchange that allows you to invest easily, safely, and transparently.

It doesn’t matter if you’re an expert or just starting out; at Bitso, you’ll find the tools you need to easily diversify your portfolio as you please, and make the most of the opportunities in the crypto market. Join today and start investing with confidence!

The information presented is purely informative and does not constitute financial advice. Please note that past returns do not guarantee future results. If you have any questions, please contact our Customer Support Team, which is available 24 hours a day, 7 days a week.