The cryptocurrency has captivated many investors around the world with its potential for high returns. However, along with these investment opportunities, come significant challenges. It’s crucial for anyone interested in investing in cryptocurrencies to approach it with the right mindset and be fully aware of the implications, understanding the risks and maintaining realistic expectations.

In this article, we’ll share all the basic tips to help you start off investing in crypto on the right foot. Let’s get started.

Understanding the Risks of Investing in Cryptocurrencies

Investing in cryptocurrencies can be exciting and highly profitable. Nevertheless, we have to recognize that it also comes with some risks. The good news is that, with a clear understanding of these risks and a smart investment strategy, you can mitigate them and navigate the crypto market with greater security and confidence.

When investing in crypto, you’ll face some challenges such as:

- The Volatility of the Crypto Market

- Possible Losses

- Hacking and Fraud Risk.

Let’s take a closer look at each of them.

The Volatility of the Crypto Market

It’s impossible to overlook the volatility of the crypto market when analyzing cryptocurrencies’ risks. It’s common to see the value of a cryptocurrency double in a single day, only to drop 30%—give or take—the next day. This kind of volatility can be intimidating for those with less experience investing in crypto, but it’s also what makes this market so attractive to those seeking high returns.

However, it is crucial to understand that these sharp movements in price aren’t anomalies, but an integral part of the crypto market. In fact, you can factor volatility into your investment strategy to take advantage of it. Many investors view these dips as great buying opportunities.

Possible Losses

Every investment carries the risk of loss, but in the world of cryptocurrencies, this risk is even more pronounced. It’s very important for new investors to keep in mind that there’s a possibility of losing part—if not all—of their investment if they don’t navigate the market wisely..

Unlike bank deposits, investments in crypto assets are not protected by a government-backed insurance fund. If you lose your cryptocurrencies due to a market crash, a hack, or any other reason, the reimbursement of your losses will depend primarily on the exchange you use. This doesn’t mean you should avoid investing, but rather, you should do so fully aware that losses are a real possibility.

There’s a reason why crypto investors say, ‘never invest more than you can afford to lose.’ But it’s also possible that if you follow this rule and invest wisely, you can make great returns on your money.

Hacking and Fraud Risk

Hackers targeting exchanges and digital wallets with lower security levels, are a constant threat in the crypto ecosystem. Over the years, there have been numerous cases where hackers have breached the security of some of these platforms, stealing millions of dollars in cryptocurrencies. These incidents highlight the importance of choosing investment platforms that prioritize security and have advanced measures in place to protect users’ funds, such as Bitso.

The Importance of Having Realistic Expectations

When entering the world of cryptocurrencies, it’s easy to get swept up by stories of people making huge amounts of money in short periods of time. While many of those stories are true, it’s crucial to approach this type of investment with realistic expectations to avoid disappointment and prevent making impulsive decisions that could lead to significant losses.

Remember, Crypto Isn’t “Easy Money”

One of the biggest mistakes new investors make is believing that cryptocurrencies are a shortcut to wealth. While it’s true that some people have made significant profits in a short period of time, these cases are the exception, not the rule.

Just like in the stock market, the crypto world has high-risk assets that can generate quick gains. However, this is a double-edged sword: chasing fast money can also lead to equally fast losses.

This doesn’t mean you should avoid taking risks in your investment portfolio. In fact, many investors choose to diversify. In other words, they don’t put all their eggs in one basket; instead, they spread their capital across low, medium and high-risk crypto assets. This way, they don’t expose all their capital to sudden market fluctuations.

Investing with a “get rich quick” mentality can lead to unnecessary risks. It’s better to adopt a long-term view and see cryptocurrencies as part of a broader investment strategy.

Know Your Investment Horizon

The investment horizon is the period of time an investor plans to keep their assets invested. In the case of cryptocurrencies, a long-term investment horizon can help you smooth out market fluctuations. This means being prepared to hold onto your investments through the ups and downs of the market, rather than selling hastily during a price drop.

By defining a clear investment horizon, you can avoid the temptation to react to short-term market volatility and stay focused on your long-term financial goals.

Patience and Discipline

Patience and discipline are essential qualities for any successful investor. In the cryptocurrency market, where prices can fluctuate from one day to the next, it’s easy to get swept up by panic or euphoria.

Even so, making investment decisions based on emotions rather than rational analysis, can be disastrous. It’s important to stay calm during times of volatility and stick to your investment plan, resisting the urge to make impulsive decisions based on short-term market movements. Having the discipline to follow a well-thought-out strategy is key to achieving long-term success.

By setting realistic expectations from the start, you can reduce the risk of disappointment and be better prepared to navigate the challenges of this volatile market. With a long-term mindset and a disciplined approach, you can maximize your chances of success in the crypto world.

Learn How the Cryptocurrency Market Works

The cryptocurrency market is dynamic, complex, and constantly evolving, which is why it’s so important to stay informed and keep up with the latest updates. Knowledge is power, and that’s definitely true in the crypto world.

To get started, it helps to understand:

- How blockchain technology works

- The differences between various cryptocurrencies

- The different investment strategies

As you deepen your knowledge of crypto, it’ll be helpful to learn how to read charts, perform technical analysis, and manage risk. It’s also essential to stay informed about:

- Blockchain updates

- Changes in crypto regulations

- Macroeconomic trends that impact prices.

This list might seem a bit overwhelming, but don’t worry. Knowledge on this broad subject is gained little by little, and as you learn more, you’ll be able to make more informed, accurate, and riskier financial decisions. Think of it like learning to swim: you ease into the water bit by bit, not with a big dive.

Getting involved in crypto communities and social networks is a great way to stay up-to-date. Forums, discussion groups, and platforms dedicated to crypto offer valuable opportunities to exchange ideas, share information, and learn from other investors.

Emotional Management: The key to Safely Invest in Crypto

In the world of cryptocurrencies, managing emotions is essential for investing safely. Impulsive decisions driven by fear or greed can result in significant losses. It’s crucial to avoid rushed purchases due to FOMO (Fear of Missing Out) or the fear of missing an apparent opportunity, as well as selling impulsively out of fear of ‘losing even more’.

It’s important to remember that market drops, though stressful, are often temporary. Staying calm during price drops and adopting a long-term mindset is key to successful investing. If you have a clear goal and a defined investment horizon, you’ll find it easier to manage the emotions triggered by daily market fluctuations.

Instead of worrying about temporary losses, focus on the bigger picture and how your investment can grow over time. This long-term perspective not only helps manage stress and anxiety, but also improves decision-making, allowing you to capitalize on market opportunities rather than reacting to its ups and downs.

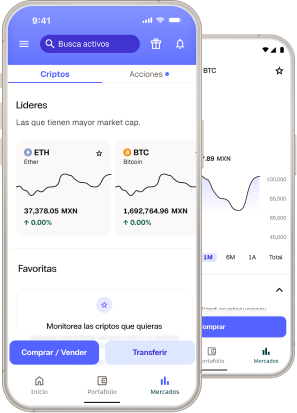

Invest Safely with Bitso

If you’re ready to begin your journey into the world of crypto, it’s crucial to do so safely and with a reliable platform. Bitso offers you a complete solution for investing in cryptocurrencies: an easy-to-use platform, advanced tools to manage your investments, and the highest security standards that allow you to trade with peace of mind.

Whether you’re just starting out or looking to diversify your portfolio, Bitso is the ideal platform to help you achieve your crypto investment goals.

Sign up today and start earning with Bitso!