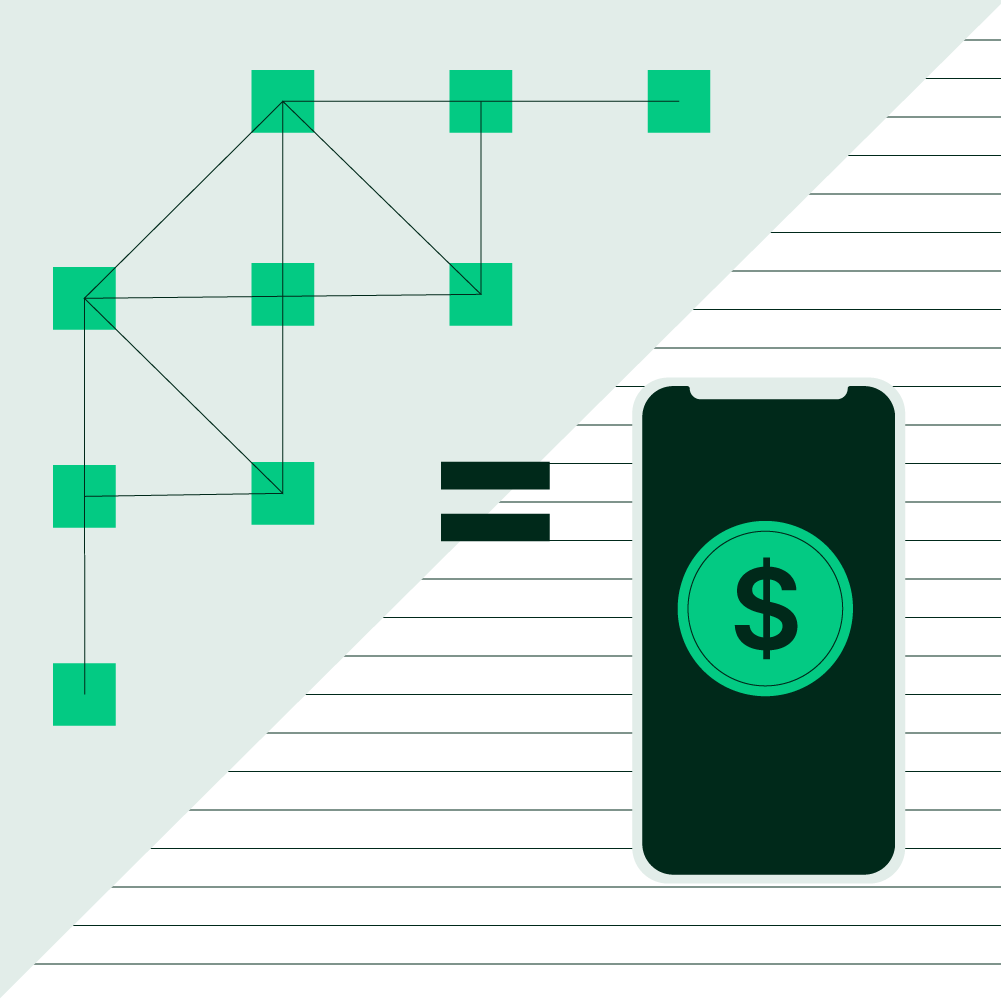

Money has been around for a very long time, though it hasn’t always been in the same form; its shape has evolved with societies throughout history.

A stablecoin is a type of cryptocurrency designed to minimize price volatility by pegging its value to a stable asset, such as a fiat currency like the U.S. dollar or a commodity like gold. These digital assets aim to combine the speed and decentralization of cryptocurrencies, with the reliability of stable assets or the security provided by over-collateralization. By maintaining a steady value, stablecoins are frequently used for transactions, remittances, wealth building, liquidity provision, and as a means of value preservation within the decentralized finance (DeFi) ecosystem.

Types of stablecoins

Stablecoins base their value on various currencies and goods. They can be classified into 5 categories:

1. Collateralized with fiat.

These are the best-known stablecoins. They maintain a 1:1 value parity with fiat currencies, such as the euro (EURC), the US dollar (USDC), or the Mexican peso (MXNB). Generally, they are backed on a 1:1 ratio. USDC stablecoin, for example, is backed with one US dollar held in reserve for every USDC issued.

2. Collateralized with commodities or goods.

A commodity-backed stablecoin is a type of digital currency that is pegged to the value of a tangible asset, such as gold or silver. Each unit of the stablecoin represents a specific amount of the physical commodity, which is securely stored by the issuer.

3. Collateralized with crypto.

These stablecoins are backed by other cryptocurrencies, meaning they base their value on other cryptocurrencies through automated smart contract systems on the blockchain. This is the case with DAI, a cryptocurrency backed by ETH and other Ethereum-based tokens through smart contracts designed to maintain its value as close as possible to the US dollar.

4. Uncollateralized or algorithmic.

These stablecoins aren’t backed by any asset, but work by using algorithms and smart contracts to manage the supply of the stablecoin in response to changes in demand. The primary goal is to maintain a stable value, often pegged to a fiat currency like the US dollar, like with Magic Internet Money (MIM).

5. Mixed collateralization.

These stablecoins are backed by a combination of different assets held as reserves, like fiat, crypto, and other types of assets or investments, like bonds. They aim to maintain parity with stable assets, typically the USD, and get their stability through the security provided by a diversified set of collateral assets.

In Bitso, we believe that the future of money involves all of us. That’s why we have partnered with MXNB, a stablecoin backed by the Mexican peso, which combines the advantages of crypto with the Mexican peso’s robustness, bringing the best of two worlds together.

With MXNB, Mexico and the rest of Latin America is now one step closer to the future of money.