Well, October burst onto the financial scene like a character from a thriller novel, complete with suspense and drama. Investors were hit with a double whammy of apprehension, thanks to the hair-raising developments in the US bond market that sent shockwaves worldwide. It was almost like déjà vu, as if last year’s UK gilt market crisis had summoned its ghostly cousin. The mere mention of these financial nightmares resurrected eerie memories of economic instability and its domino effects. To top it all off, a new conflict in the Middle East decided to join the party, adding an extra layer of worry for the already-jittery investors.

September, oh dear September, had been a real downer. Financial assets were performing as if they had a bad case of the Monday blues. Stocks were tripping, bonds were taking a nosedive, and currencies were riding the turbulence roller coaster, with the US dollar holding court like a king. But wait, in this sea of gloom, there was a shining star – Bitcoin.

Despite facing some hefty headwinds and trading volumes that made crickets sound loud, Bitcoin had the audacity to close September with gains. It’s like the rebellious teenager in a room full of conformists. And that resilience didn’t stop there; it carried on into October, with Bitcoin continuing to perform like the financial equivalent of a rockstar, providing a ray of hope in a rather stormy financial landscape.

Adding some more spice to the already spicy market conditions, the economic data from the US is playing a game of “Guess the Plot.” It’s like the economy itself can’t decide if it wants to be a drama or a comedy. Investors are left scratching their heads, not sure whether to laugh or cry at the data.

Oh, and let’s not forget the Federal Reserve, the market’s security blanket. But alas, there’s no Fed meeting until November, and that’s like waiting for a superhero when the city is under siege. Investors are left to engage in some heavy-duty speculation about the central bank’s next move and what it might mean for their precious assets. Rumor has it that the Fed might be done with its rate-hiking shenanigans, but the real question is how long they plan to keep interest rates at their current levels.

And just when you thought things couldn’t get crazier, on October 16, some jokers played a trick with false reports of BlackRock ETF approval, sending Bitcoin’s price skyrocketing to nearly $30k. Of course, the party didn’t last, and Bitcoin came back down to earth once the news was debunked. But wait, there’s more! Over the weekend, Bitcoin decided to give it another shot and retest the $30k level. It’s like watching a rollercoaster ride at an amusement park but at least it seems we’re closer to breaking out of the trading range that have shackled Bitcoin in the last months.

.

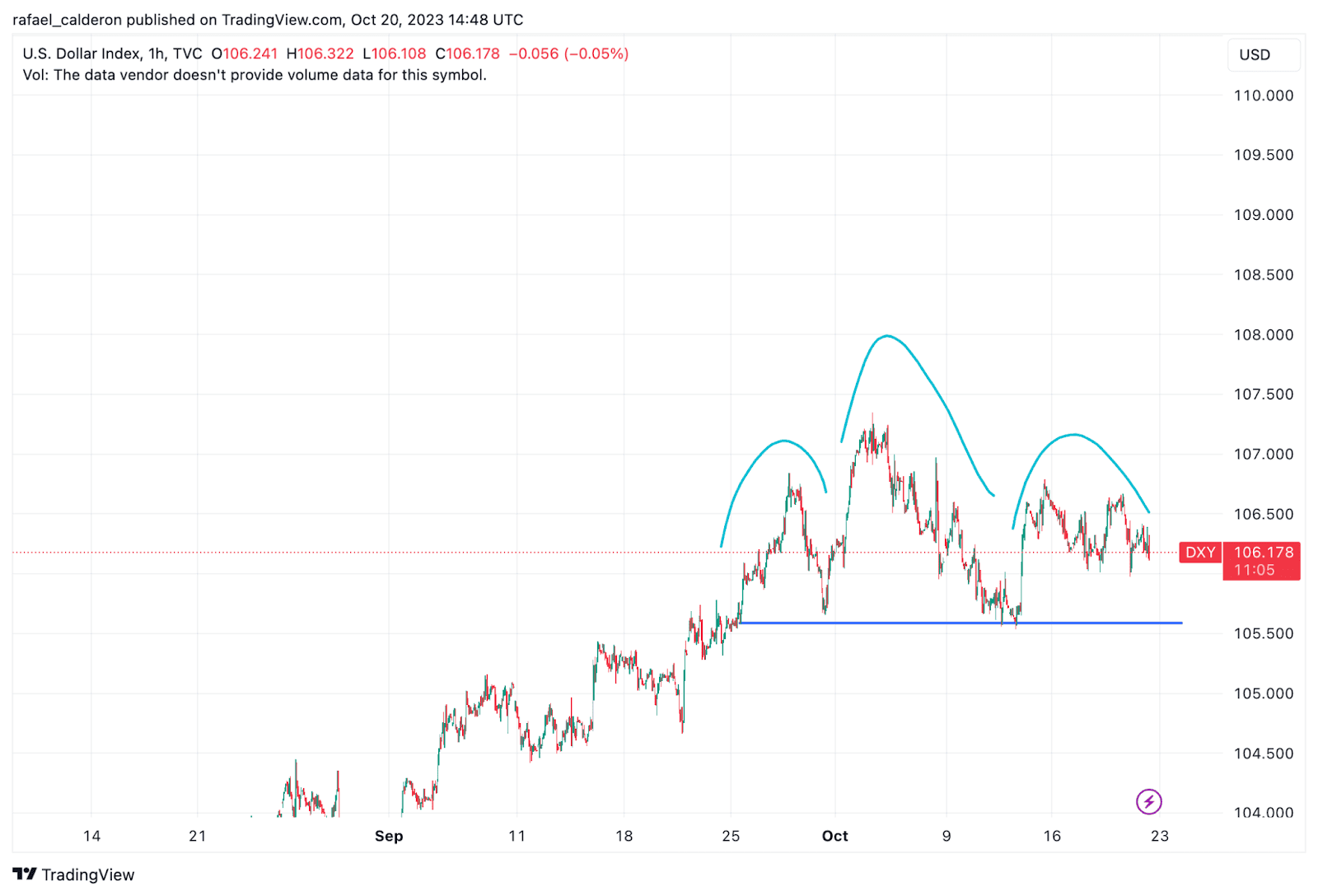

Here’s the kicker – the dollar and bond yields are behaving like they’re in a complicated relationship. Normally, you’d expect the dollar to rise with increasing yields, but nope, not this time. It’s like watching a rom-com where the plot takes an unexpected twist. In fact, the dollar seems to be shaping up for a head-and-shoulders pattern, which, if confirmed, could spell trouble for the greenback, potentially giving cryptocurrencies and other assets a boost.

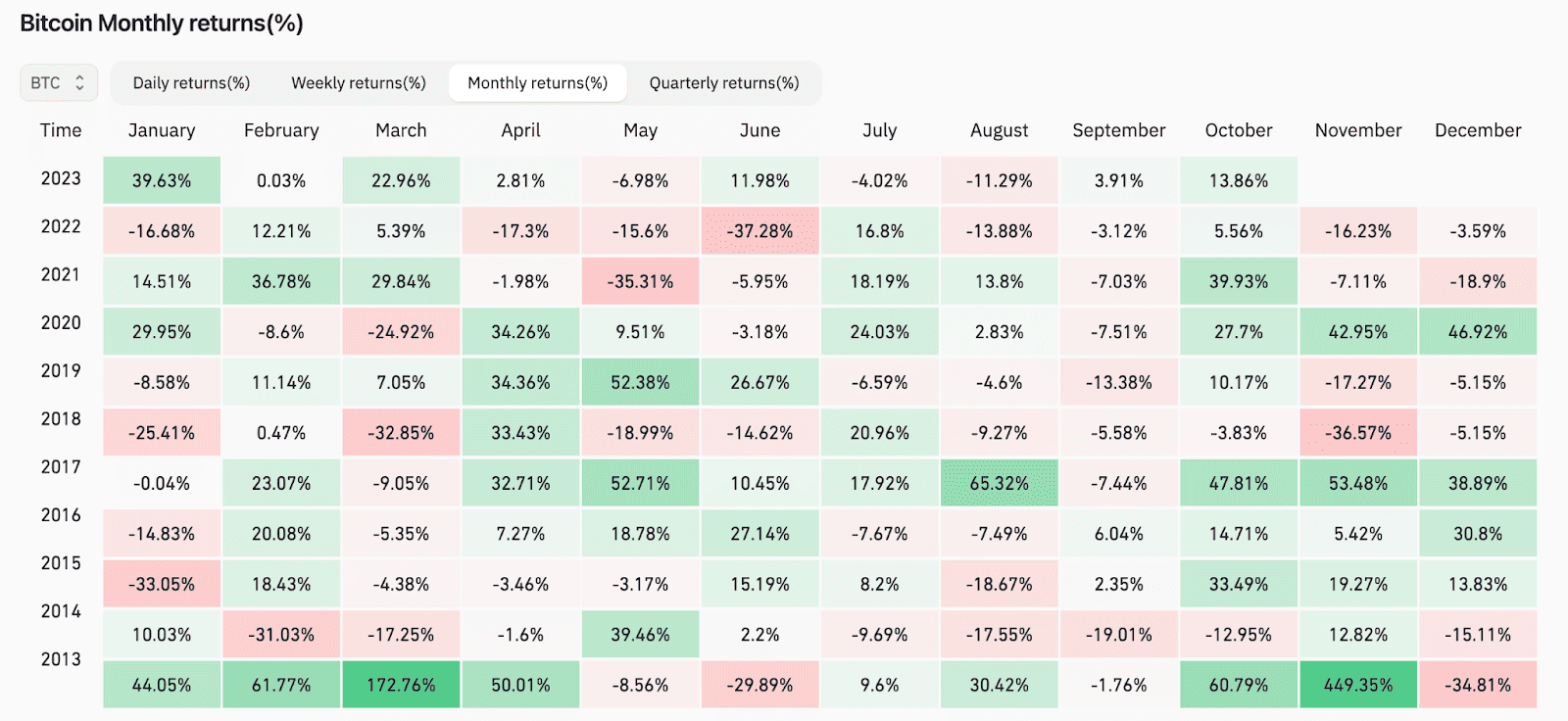

So there you have it, October, with all its rollercoaster-like ups and downs, has brought an atmosphere of unease and volatility in the financial markets. It’s like a movie with multiple plot twists. And while it might leave investors on edge, it’s also giving Bitcoin a chance to shine. With all this chaos, you can’t help but wonder if we’re in for a crypto performance reminiscent of the good old days of 2015 and 2016, where a green September paved the way for a spectacular Q4. Buckle up, folks; it’s going to be an exciting ride!