Everything that glitters truly shine, right?

A conversation that constantly repeats itself at family dinners and in chat groups is: “Is gold having a moment? Should I buy gold?”

Watching gold climb approximately 40% in 12 months naturally generates a short-term feeling of FOMO (Fear of Missing Out). Especially since, from the beginning, the yellow metal has been one of the classic store-of-value assets. Investors tend to gravitate toward gold when markets are uncertain; the instinct is to return to the most familiar and stable investments.

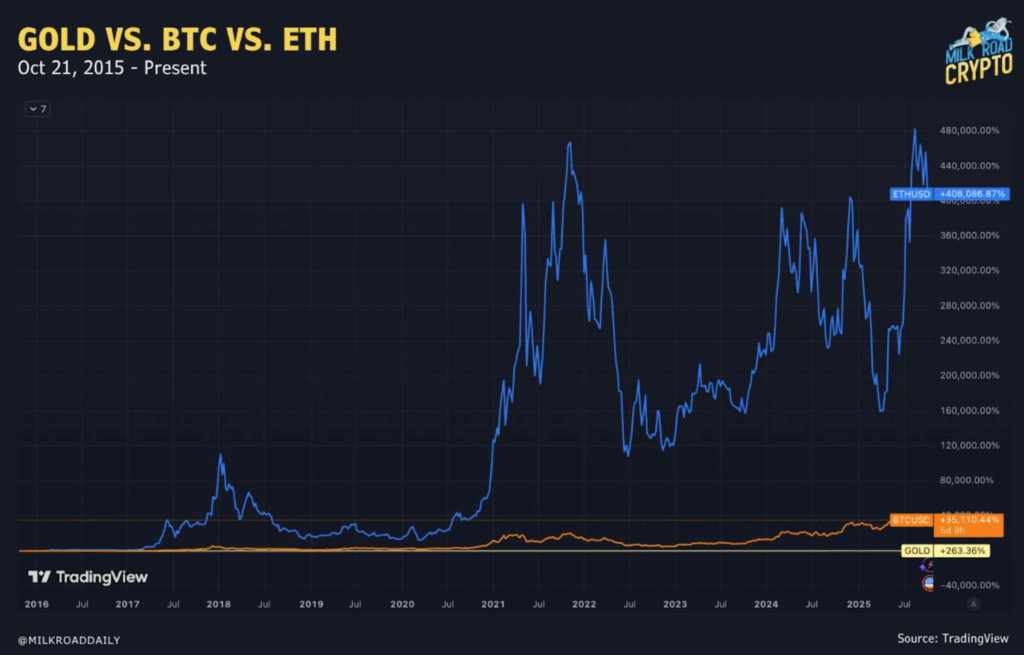

To start: If you invest with your future self in mind, if your goal is to build long-term wealth, this is what the last 10 years of performance data for gold, Bitcoin, and Ethereum show us.

Bitcoin vs. Gold

When you look at the performance data for Bitcoin and gold on an extended 10-year timeline, the narrative of gold as the “best deal” changes. This is due to the difference in growth potential.

- Gold: Its value has increased by approximately 240%, which is considered a solid and stable return.

- Bitcoin: It has grown by approximately 32,500%, which is an explosive return.

Myth or Reality: Is it too late to invest in Bitcoin?

If you haven’t asked yourself this question, you’ve probably heard it. This is the modern investor’s primary fear.

However, the 10-year chart debunks that idea. It is not too late to invest in Bitcoin. Its value is not based solely on price, but on the mathematical certainty that it is the only asset with immutable rules and programmed scarcity, with its limit being 21 million units.

Ethereum, the growth “plot twist”

Now, if Bitcoin’s performance surprises you, prepare to look at the last decade of Ethereum.

While Bitcoin consolidated itself as the “digital gold,” Ethereum focused on being the fuel that gives life to an entire new financial system, becoming the “digital oil.”

The result? Ethereum’s (ETH) returns have been 10 times higher than Bitcoin’s over the last decade.

The long-term profitability of Bitcoin, Ethereum, and gold shows that ETH, the second-largest cryptocurrency by market capitalization, is an aggressive growth asset and fundamental for investment diversification.

The Modern Investor’s Key: Diversification

The key to navigating the crypto world with its volatility and explosive growth is diversification.

Just as you wouldn’t put all your investment into a single stock, crypto, or currency, a balanced portfolio contains:

- Store-of-value assets: BTC.

- High-growth potential assets: ETH and other altcoins.

- Stable assets: Tokenized gold with PAXG or stablecoins like USDC (Digital Dollars).

The Stage is Set: Take Control of Your Financial Story

At Bitso, we know everything starts with a big step. Your investments deserve to grow, and that’s why we offer you a secure and regulated platform to do so. The tools are already in your hands. Take the first step today and give your money the growth potential it deserves.

Download or open your Bitso app today and take the next financial step with confidence. Your portfolio is waiting for you!