There are several crypto investment strategies you can apply depending on your risk profile and objectives, but a basic strategy —regardless of what type of investor you are— is definitely diversifying your portfolio. Diversification is not just about buying different crypto assets, but about understanding how you can leverage different investments to build a strategy that works for you across varying market conditions. This article will help you understand how you can diversify your crypto investments to achieve a balanced portfolio that fits your goals and risk tolerance. We will also have a look at other complementary strategies for each investor profile: cautious, moderate or daring.

Brief Introduction to Diversification

Diversifying your portfolio means spreading your investments across different assets to mitigate the risks that come with crypto market volatility. To put it simply, it’s about not putting all your eggs in one basket. By spreading your capital across different assets, if one of them drops sharply, investments in better-performing assets can compensate for those losses, balancing the total return of your portfolio.

Another stage of crypto diversification is investing not only in different assets, but also in different types of crypto. In addition to reducing risk, this allows you to leverage growth opportunities in different sectors of this market.

Check out our article for an in-depth guide on diversification.

What type of investor are you?

The three investor profiles

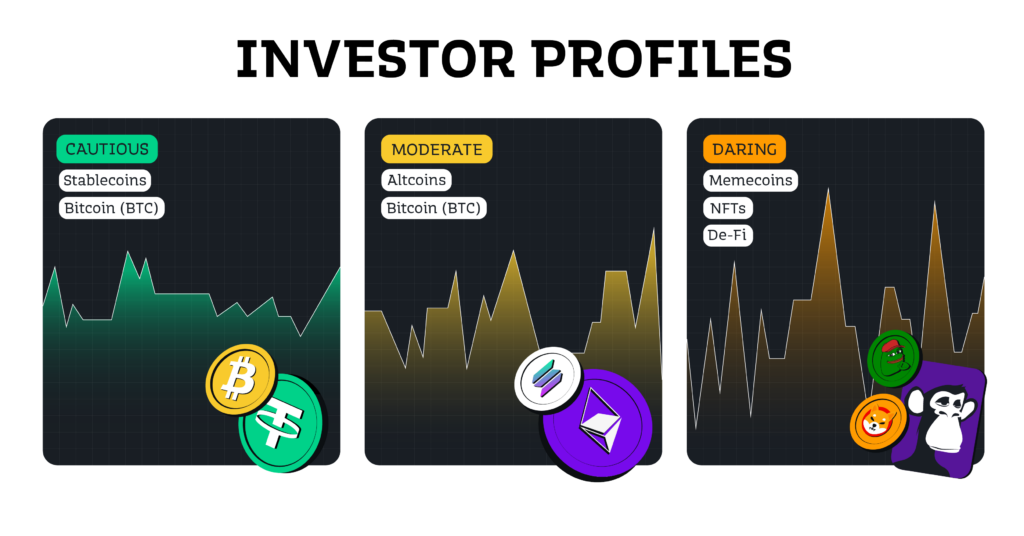

To effectively diversify in the crypto market, it is essential to understand which is your risk profile. Below, you’ll find three main types of investors, each with its own characteristics and preferred investment strategies:

- Cautious investor

- Moderate investor

- Daring investor

Let’s take a detailed look:

Cautious investor

The cautious investor seeks security and stability. They prefer to avoid significant risks and protect their capital, sacrificing potentially high profits in exchange for minimizing losses. In the crypto market, this type of investor tends to prefer less volatile assets, such as bitcoin or stablecoins, and opts for limited exposure to more speculative cryptocurrencies. Their goal is to preserve the value of their investment and obtain predictable returns.

Moderate investor

The moderate investor is open to taking calculated risks to strike a balance between security and growth. They aim to capitalize on the growth potential of the crypto market, but with a controlled approach. This type of investor puts money into both well-established cryptocurrencies, like bitcoin or ether, and emerging assets or innovative projects with growth potential. Their objective is to achieve steady growth without exposing their capital to excessive risks.

Daring investor

The daring investor is willing to take on significant risks in search of high returns. Their approach focuses on leveraging the high volatility of the crypto market, investing in emerging altcoins, speculative projects or newly launched tokens. Although they acknowledge there is a possibility they could suffer significant losses, their goal is to maximize returns in shorter time frames. It is common for this type of investors to explore niches like DeFi, NFTs or memecoins.

While there are many online tests to identify your investor profile, you may discover it best through experience. As you invest in crypto, you will learn your true risk tolerance for market fluctuations. In addition, your investor profile may change over time and circumstances. For example, a 20-year-old with no financial responsibilities such as rent or utilities will likely take on more risk than a 50-year-old with a family to support.

How to build your crypto investments portfolio

Building your crypto investment portfolio is one of the most important steps to capitalize growth opportunities and manage risk effectively. In order to do this with greater confidence, you can follow the guidelines corresponding to your investor profile. This will give you a solid foundation from which to continue learning and evolving in the investment world.

Below you will discover how a well-crafted diversification can balance risks and boost your financial growth in crypto.

Crypto portfolio and strategies for moderate investors

As we mentioned earlier, the cautious investor looks for safe crypto investments and prioritizes the long-term stability of their funds. If you can relate to this, keep in mind that no investment is 100% safe, but you can still build a crypto portfolio that minimizes risk and preserves the value of your investment.

Here are some portfolio diversification strategies used by cautious investors:

- Going for stablecoins like USDT and USDCStablecoins are cryptocurrencies whose value is pegged to more stable assets, such as the U.S. dollar. These digital currencies offer greater stability, as they are not subject to the substantial fluctuations of the crypto market. Holding a significant portion of your portfolio in stablecoins protects your funds and ensures liquidity, even during times of high volatility.

- Invest in well-established crypto market coins like BTC and ETH

Despite the volatility of the crypto market, bitcoin (BTC) and ether (ETH) have shown themselves to be the most well-established and stable cryptos over the long term. Even though their value varies, they have endured multiple market cycles and are regarded as a safe choice within the crypto ecosystem. Adding BTC and ETH to your portfolio gives you access to significantly higher growth potential than stablecoins, yet with moderate risk compared to altcoins or new projects.

In addition to portfolio diversification, people with this profile often employ other long-term investment strategies such as the ones listed below:

- HODLing: a widely used strategy in the crypto world consists of buying and holding assets for long periods of time without selling, based on the belief that their value will rise substantially over time.

- DCA (Dollar-Cost Averaging): a highly popular investment strategy in the crypto world consisting of investing a fixed sum of money in a specific asset (such as bitcoin or ethereum) periodically regardless of its price.

Crypto portfolio and strategies for moderate investors

Moderate investors seek to strike a balance between risk and reward. They are willing to take on some level of risk to obtain higher returns than those offered by a cautious approach, but are still somewhat conservative.

The diversification strategies typically used by this type of investors are similar to those chosen by conservative investors, with certain differences in percentages and preferred assets. Let’s take a look:

- Holding a stock of BTC and ETH

Bitcoin and ether remain essential to any well-diversified portfolio. For the moderate investor, substantial exposure to BTC and ETH provides security, but also significant growth potential, as both assets have a strong track record and are fundamental to the crypto ecosystem.

- Including stablecoins

Like cautious investors, but to a lesser extent, those with a moderate profile invest part of their funds in stablecoins to mitigate potential losses from riskier cryptos in their portfolio.

- Investing in established altcoins like SOL and ADAIn addition to bitcoin and ethereum, some projects have shown relatively low volatility and a strong track record. Cryptocurrencies from networks such as Solana (SOL) or Cardano (ADA) can be a further option to diversify with assets that, while volatile, are less speculative than other emerging tokens. You can allocate a small part of your portfolio to this type of asset, and still keep risk within a moderate level.

In addition to diversifying their portfolio, they often implement other investment techniques:

- Diversification into specific themes or sectors: investing in different crypto categories or themes can help reduce the risk exposure of a single sector.

- Investment in financial projects with passive returns

A passive investment strategy may include staking, yield farming or participation in decentralized lending platforms (DeFi). These options allow investors to earn recurring income without the need for active management of their investments. For example, by staking tokens on blockchain networks, investors receive rewards for the assets locked in the corresponding network. Similarly, in yield farming, returns are generated by providing liquidity in DeFi protocols. These strategies require risk analysis, but offer sustainable passive income opportunities.

- Swing trading

Swing trading is a short-term active investment strategy that stands somewhere between the popular “HODLing” or holding (a long-term strategy) and dynamic day trading. It consists of holding the investment in assets for several days or weeks, with the objective of benefiting from market fluctuations. The trader seeks to sell on the highs and buy on the lows, analyzing the speed at which prices change to make the most of these movements in market momentum and generate profits. This strategy requires active involvement, as it involves constantly monitoring the markets and analyzing price patterns in order to make informed decisions, make the most of fluctuations and maximize profits.

People with this profile seek opportunities related to emerging assets and speculative projects, accepting the risk of significant losses. They are willing to accept greater volatility and the possibility of losing capital in exchange for high return opportunities. Remember though that, even if you are an experienced investor and willing to tolerate losses, it is not advisable to invest money that you cannot afford to lose.

Now let’s look at some portfolio diversification strategies employed by those who aim to maximize returns with a high-risk approach:

- Keeping a small reserve of reliable assets

Although the main focus is on taking risks, allocating a percentage of the investment to stablecoins and consolidated cryptocurrencies such as bitcoin or ether is still advisable in order not to leave the investment completely exposed to volatility and to provide a minimum of stability to the portfolio.

- Adding more volatile cryptocurrencies

With a foundation of BTC, ETH, and stablecoins, adventurous investors can explore more volatile coins. Innovative projects like Fantom (FTM) or AAVE can offer benefits.

- Venturing into memecoins

Although extremely volatile, this type of asset can offer very high returns in the short term. Examples such as Dogecoin (DOGE), Shiba Inu (SHIB), and other tokens that have gone viral, have multiplied many times their value in times of speculative boom. However, these coins often have little real utility and their success depends largely on social trends and speculation.

Alternative strategies used by investors with a risk-taking profile include:

- Day trading

Day trading is an active investment strategy in which traders buy and sell assets on a single day in order to take advantage of short-term price fluctuations. It can be done with any type of crypto, from BTC to memecoins.

- DeFi

Within DeFi platforms you can find projects that offer very high returns, but are generally much riskier than others which are already more established, with mass adoption and regular audits.

- Initial Coin Offerings (ICOs)

It is a form of fundraising used by cryptocurrency and blockchain projects. This mechanism resembles an Initial Public Offering (IPO) of traditional markets, but instead of shares, investors buy tokens of the new project with the expectation that they will increase in value as the project grows and develops. These types of investments are considered high risk for a number of reasons, including lack of regulation, potential scams, or project failure. But when a project is successful, buying tokens at an early stage can be a great investment.

This material is for informational purposes only and does not constitute financial advice. Please note that past performance is no guarantee of future results. If you have any questions, please contact our Support Team who are ready to assist you 24/7.