Hey there, financial thrill-seekers and crypto enthusiasts! Last weeks have been quite the wild ride, with the Federal Reserve making waves and the crypto world serving up its fair share of surprises. So, grab your seatbelts and join us as we navigate through the twists and turns of this month’s financial and crypto rollercoaster.

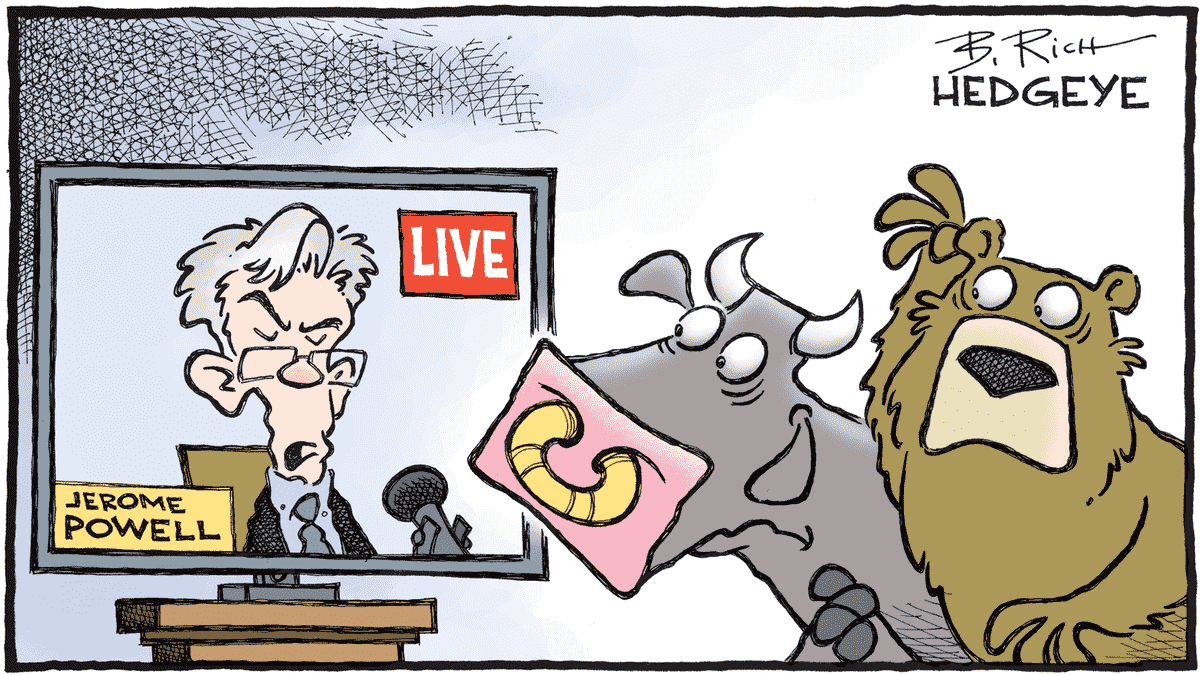

The Federal Reserve had its moment in the spotlight, and boy, did it deliver some drama. As expected, interest rates remained steady, but the Fed whipped out its hawkish feathers. They believe this monetary policy stance can take on inflation without throwing the economy into a tailspin or causing job losses that rival a magician’s disappearing act. There’s even a possibility of one more interest rate hike this year, pushing that benchmark rate to a dazzling 5.50% to 5.75%.

Investors, however, seem to be playing it cool. Market expectations for the final two Federal Open Market Committee (FOMC) meetings of 2023 haven’t shifted much. It’s like they’re saying, “C’mon Fed, show us what you’ve got!” The central bank seems to be holding off on those rate cuts until next year, as inflationary pressures cool down.

Regardless of the Fed’s interest rate moves, we might be nearing the end of the tightening cycle. Historically, after a rate hike, real interest rates dropped, and the equity market put on a show. Crypto, however, has been stuck in a rut due to rising real interest rates and a correlation with the tech stock tumble. Bitcoin’s dance in 2022 was practically a mirror image of those tech stocks’ moves. Lower real rates and a firmer stock market could be the crypto party favor we’ve all been waiting for.

But hold onto your crypto wallets, folks, because there’s no guarantee that history will repeat itself. The Fed might continue its portfolio slimming routine, pushing those real interest rates up. Plus, the stock market, while riding high lately, could trip and fall if we hit an economic recession. A “soft landing” might get crypto back on its feet quickly, but a “hard landing” could mean more time in the land of price stagnation.

Speaking of crypto, Bitcoin’s been on a rollercoaster of its own. It’s been holding onto that $25k support level like your favorite teddy bear. Nothing new for you if you read our article in July. But when it comes to clearing the $30k hurdle, it’s been a bit of a drama queen. And guess what? Other cryptocurrencies are in the same boat. Talk about group therapy!

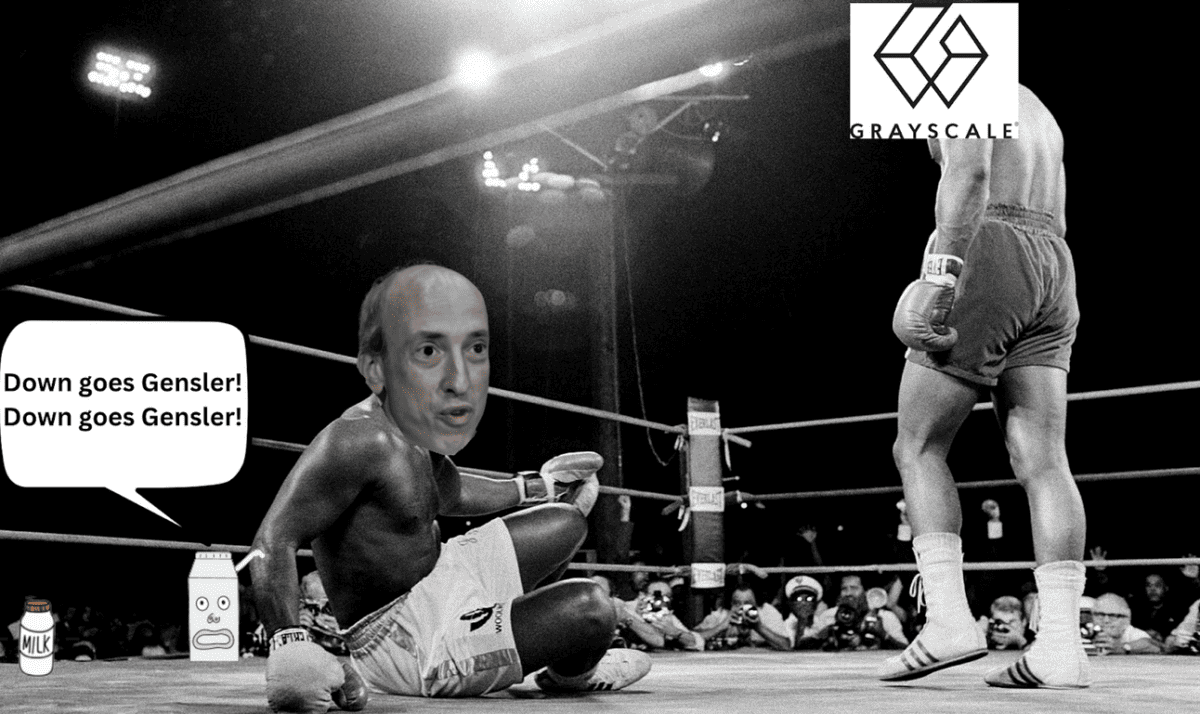

Away from price action, the crypto world has been quite the soap opera. Grayscale, with its massive Bitcoin trust, won a legal showdown against the SEC. They’re eyeing a Bitcoin spot Exchange Traded Fund (ETF) like it’s the golden ticket. If approved, this ETF could be a game-changer, giving investors access to a well-regulated product that tracks Bitcoin’s value more closely than those futures-based ETFs that love to play hard to get.

But that’s not all! The SEC has added a dash of mystery to its Binance case by filing a sealed motion with over 35 exhibits. It’s like they’re keeping secrets in a locked treasure chest. Speculation running wild—maybe it’s to avoid tripping up a DOJ investigation, or perhaps they’re guarding a key witness like a top-secret agent. Whatever it is, it’s adding a whole lot of drama to an already complex crypto legal saga.

In the grand finale, we’re at a crossroads with the Fed’s policy rate hikes, and that’s a big deal for Bitcoin and the crypto gang. The crypto ecosystem continues to evolve daily–with new applications, enhancements to existing protocols, and wider adoption–but token prices do not always track this progress. The show’s been heavily influenced by the macroeconomic backdrop and the Fed’s monetary magic tricks—from easy policies in 2020 to recent rate hikes. The end of this monetary spectacle could mean smoother sailing for crypto valuations, letting them shine brighter as the crypto universe continues to expand.

So there you have it, folks—a month packed with financial twists and crypto turns. Stay tuned for the next thrilling episode in the world of finance and digital currencies. It’s bound to be a wild ride!