While there are many ways to trade cryptocurrencies, not all of them are the right fit for every person. After all, with great risk comes great responsibility — especially because of the volatility of the crypto market.

Some traders go for long-term approaches, while others enjoy the thrill of day trades in crypto markets. It all comes down to each individual trading personality.

In other words, factors like risk tolerance, emotional stability, time commitment, decision-making style, and response to market volatility all play a major role in the operation.

Although every trader should have a firmly established plan and a clear sense of what their goals are, it’s quite common for day traders to act in impulsive ways.

In a survey conducted by Exness, nearly a third (34%) of traders admitted making quick decisions without proper planning or analysis.

There’s no one-size-fits-all approach when it comes to trading cryptos or other assets. Remember, what works for one person may not work for you, and vice versa.

So, the question remains: what is the best trading strategy for you?

Let’s dive into some of the most popular trading strategies to shed light on the topic and ultimately help you decide on the most suitable approach to your crypto operations!

5 Best Trading Strategies

- Buy and Hold.

- Day Trading.

- Scalping Trading.

- Swing Trading.

- Trend Trading.

1. Buy and Hold

The buy and hold strategy involves buying an asset and holding onto it for a specific period, regardless of price fluctuations. The goal is to achieve long-term gains over several years or even decades.

Bitcoin is a prime example of how traders have historically used the buy and hold strategy. The pioneer cryptocurrency’s first increase was in 2010, when it rose from $0.0008 to $0.08. In 2017, there was a 1,950% increase in its value, jumping from $974 to $20,000.

Buying and holding is the best trading approach for those investing in assets with a history of gradual but steady growth. As a buy-and-hold trader, you’re effectively prioritizing potential long-term gains over short-term market volatility.

Is it worth it investing in crypto?

In the cryptocurrency world, this strategy is often referred to as HODLing. The term “HODL” originated from a misspelling of “hold” in a Bitcoin forum and has since become synonymous with long-term cryptocurrency investment. Now, it stands for “Hold On for Dear Life.”

Buy and Hold is the best trading option for: patient, risk-tolerant individuals who have a long-term investment perspective and are comfortable with holding crypto through various market fluctuations.

2. Day Trading

Day trading is popular in the cryptocurrency community due to its volatile nature, which attracts many professional traders that analyze the market daily to find the best opportunities to buy and sell.

Also referred to as intraday, or one-day time horizon, this method is all about buying and selling assets within a single day.

Let’s say, for example, that you decide to buy some Bitcoin shares in the morning because you think the value will go up during the day.

As the day goes on, the Bitcoin price indeed rises a bit. So you sell it to lock in a small profit, and you’re done for the day. You don’t hold any Bitcoin overnight, and you can start fresh and make new trades the next day.

While day trading sounds potentially profitable, it carries significant risks due to the inherently volatile, unpredictable nature of the cryptocurrency market. There’s no way to predict changes on an hour-to-hour or minute-to-minute basis, regardless of how many charts traders use.

The erratic, wildly uncertain nature of these markets make day trading unsuitable for beginners and less experienced investors.

Day Trading is the Best trading option for: active and disciplined traders who can make quick decisions, monitor the markets, and handle the stress of intraday trading.

Find out more: What is trading and how does it work?

3. Scalping Trading

Scalping is another fast trading method where assets are bought and sold within minutes or even seconds. This high-frequency strategy is used by a small group of highly experienced pro traders.

When scalping, these investors keep a close eye on the cryptocurrencies market and use technical analysis tools to identify potential entry and exit points.

Scalpers capitalize on even the tiniest price fluctuations, doing it over and over throughout the day. Their overall aim is to be able to add up all the small profits to make a decent overall gain by day’s end.

One key advantage of scalping is that it minimizes exposure to market risks. Scalpers reduce their chances of being affected by major market shifts or sudden price crashes by holding positions for such brief intervals of time.

While the concepts of day trading and scalping may sound similar, there’s actually a key difference between these two strategies.

A scalping trader holds a financial asset for less than five minutes, often keeping a deal for just two minutes or less. Day traders, on the other hand, concentrate on larger time frames and look for opportunities based on 15-minute, one-hour, and four-hour charts.

Both strategies require discipline, as emotions can get in the way of making these quick but highly consequential decisions. You must always have a carefully considered trading plan and stick to it, avoiding impulsive moves that may lead to losses.

Scalping is the Best trading option for: traders who are focused, have excellent analytical skills, and can act swiftly to capitalize on small price differentials.

4. Swing Trading

Swing traders don’t hold assets on short time horizons on the order of hours or even minutes like day traders do. But they also don’t hold their cryptocurrencies for months or years, the way long-term buy-and-hold investors do. Instead, they hold the asset for a few days or weeks, making the most of short to medium-term price movements.

For example, let’s say you want to try swing trading with a cryptocurrency like Ether.

You see that the price of Ether (ETH) has been rising for the past few days. You also believe it will continue to increase in the near future due to positive news. Based on that information, you decide to buy the crypto at its current price.

After a couple of days, the price of Ethereum goes up, as you anticipated it would. A few days after that, though, you notice signs that the price might start to decline as some negative rumors are circulating. Thus, you decide to sell your Ethereum at this higher price to secure your profit.

Learn more about: Bitcoin vs. Ethereum: Which Is the Better Buy?

Like any trading style, swing trading comes with its own set of risks. Since swing traders hold their positions for a longer duration compared to day or scalp traders, they expose themselves to the potential for more substantial losses.

One significant risk for swing traders is holding positions overnight. The overnight market can be unpredictable, and events like economic news releases or geopolitical developments can cause significant price gaps when the market opens the next day.

Swing is the best trading option for: adaptable traders who are able to analyze medium-term trends, and have enough time to manage positions over several days or weeks.

5. Trend Trading

Follow the trend, as people say. This simple, tried-and-true concept is actually surprisingly applicable to trading cryptocurrencies.

Trend trading, also known as momentum trading, is a strategy that follows the direction of the market trend, instead of trying to predict where the market will go.

Trend traders look at past price movements using technical analysis and execute trades in the direction of the trend.

When you’re a trend trader, you’re focused on buying assets based on their upward momentum and then selling them once that trend begins to reverse. It’s a strategy that many individuals keep in their arsenal, whether they’re beginners or pro traders.

However, self-control is important for trend traders, since sticking to whatever the trend of the moment is can be challenging. At the same time, they must stay alert for signs that the trend is ending or is about to shift in another direction.

Trend is the best trading option for: traders who have a strong understanding of technical analysis, the ability to spot long-term trends, and the patience to stay in trades for extended periods.

What is the best trading strategy?

The best trading is a subjective matter. Further, no matter which strategy you decide on, there are never any guarantees of success. Whatever strategy you ultimately choose should be one that suits your personality, discipline level, available capital, risk tolerance, and schedule.

Something important to remember, too, is that the best traders are adaptable. They’re open to changing their trading strategy based on opportunities and needs. So it’s a good idea to learn about each individual trading approach so that you can become adaptive to the ever-evolving cryptocurrency landscape.

One thing’s for sure, though: you need to have actual cryptocurrency in your wallet before you can implement the right option to help you achieve your goals.

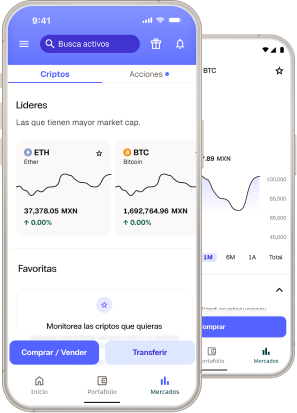

And with Bitso, you get much more than a crypto exchange. It’s a complete platform for crypto solutions, including buying, selling, payments, and much more!

Open your account to join the over six million people who have chosen Bitso to stay informed about crypto trends in real-time!