We know that many investors are put off by the infamous volatility of the crypto market. However, we don’t think you should be discouraged by it; volatility can also bring opportunities!

Prices of major digital currencies can soar dramatically within hours and, equally, plummet. This rollercoaster of prices may be a cause of concern for some, but, actually, volatility can be a powerful tool when factored into well-defined investment strategies.

Keep reading to discover how to work with market fluctuations on your side.

What is volatility, after all?

Volatility refers to the rate at which prices move up and down. It is influenced by various factors such as industry news, technological developments, government regulations, and even global macroeconomic events. While this characteristic can be challenging for some, more experienced investors know that volatility also presents unique opportunities.

Taking control of volatility

Cryptos are volatile in the short term, but that shouldn’t stop you from investing. Perceiving this volatility not as a problem, but as part of the crypto market, is the first step to a successful strategy.

Having a long-term vision can be a good approach to make the most of the crypto price variation.

A quick example of how patience can pay off when investing in cryptos:

There are some strategies and tools that can be used to take control or advantage of the volatility of the crypto market.

Check this out:

Investing in fixed intervals

DCA, or Dollar Cost Averaging, is a proven investment strategy. It involves investing a fixed amount on a specific asset at regular intervals, in order to smooth out the impact of the market volatility on your portfolio. For example, if you were to invest the same amount every month in a particular crypto, you’d end up paying the average price of the crypto, regardless of its highs and lows for the time you invested in it. This way, you are most likely to get decent returns on your investment, without the stress and hassle that comes from constantly monitoring the market.

Diversification

Spreading your investments across various cryptos can also help you reduce the negative impact of the market volatility. A diversified portfolio can benefit from the positive performance of certain cryptocurrencies, potentially offsetting losses from the ones that are falling.

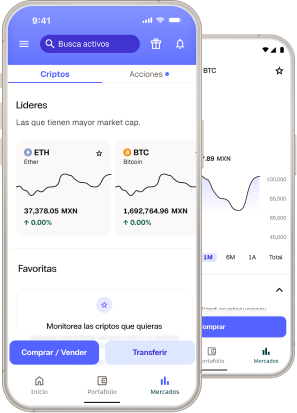

At Bitso you can find more than 50 cryptocurrencies to add to your portfolio, including stablecoins pegged to the dollar, euro or gold.

Market Analysis

Last but not least, you can always keep an eye on the market. Our charts, widget, blog posts, and many of the specialized crypto websites out there, are a great source of information. They can help you identify patterns and trends that may indicate future price movements, allowing you to take advantage of the fluctuation in crypto prices.

Here at Bitso, your cryptos are always safe. Don’t let the market volatility hold you from investing and earning more.

Open the app and take advantage of all that Bitso has to offer. It’s safe; we’ve got you covered.