In recent years cryptocurrencies have experienced an exponential growth, drawing investors from all over the world. While some seek quick profits, there is a growing awareness of the benefits of long-term investments in crypto. If you are concerned about losing money by investing in the short term, this article is for you.

Continue reading and discover how a long-term strategy can help you.

Why invest in the long term?

The search for quick profits often leads to impulsive decisions and the loss of unique opportunities in the world of cryptos. Moreover, obtaining short-term gains is a difficult task as it requires extensive study, knowledge, and dedication.

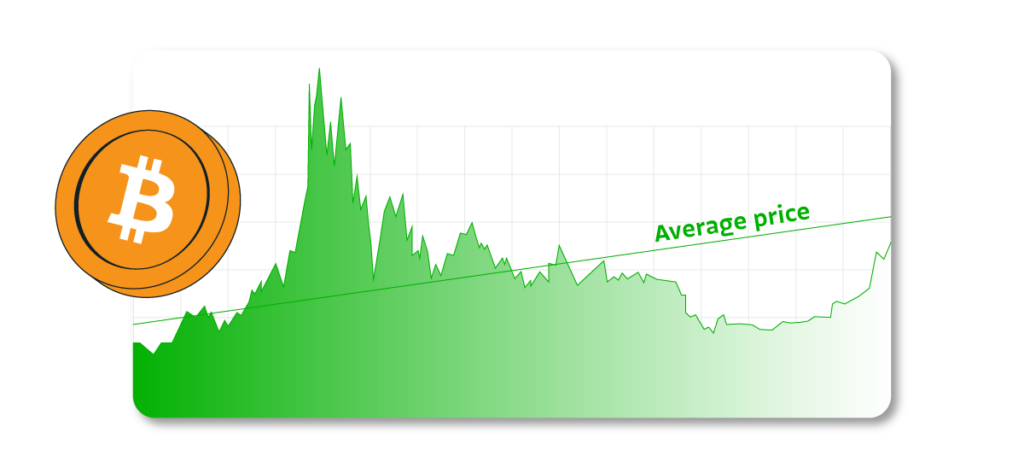

On the other hand, investing for the long term allows investors to smooth out the highs and lows of the market, paying for the average price of the crypto in the long run.

There is a proven long-term investment strategy to help you do well over time: DCA, or Dollar Cost Averaging.

What is DCA and how does this strategy work?

DCA, or Dollar Cost Averaging, is a proven strategy that can help you when investing in the long term. It involves investing a fixed amount at regular intervals, smoothing out the impact of market volatility on your portfolio.

Look how easy it is:

- Choose a specific crypto and a fixed amount to invest in it (100 pesos, 1000 pesos or as much as you want).

- Define the interval (every day, week, or month).

- Stick to the strategy and maintain consistency.

In 1, 2, 5, or 10 years, you’ll have paid the average price of the crypto, regardless of the highs and lows.

These are the key benefits of this strategy:

Lower Risks

Dollar Cost Averaging (DCA) smooths the impact of price fluctuations. Since the investment amount is fixed, the DCA strategy automatically adjusts to market risks. During periods of high volatility, more units are acquired at lower prices, while in times of market highs, fewer units are bought at higher prices.

Cost Averaging

Investors achieve a cost average over time by purchasing regularly, regardless of price. This means they are not fully exposed to sudden price peaks or troughs.

No Timing Worries

There is no need to try to predict the ideal time for investing.

Helps with Savings

Regular investments encourage financial discipline and promote savings.

There are lots of long-term investment opportunities waiting for you. Go to the app and improve your investment strategies.